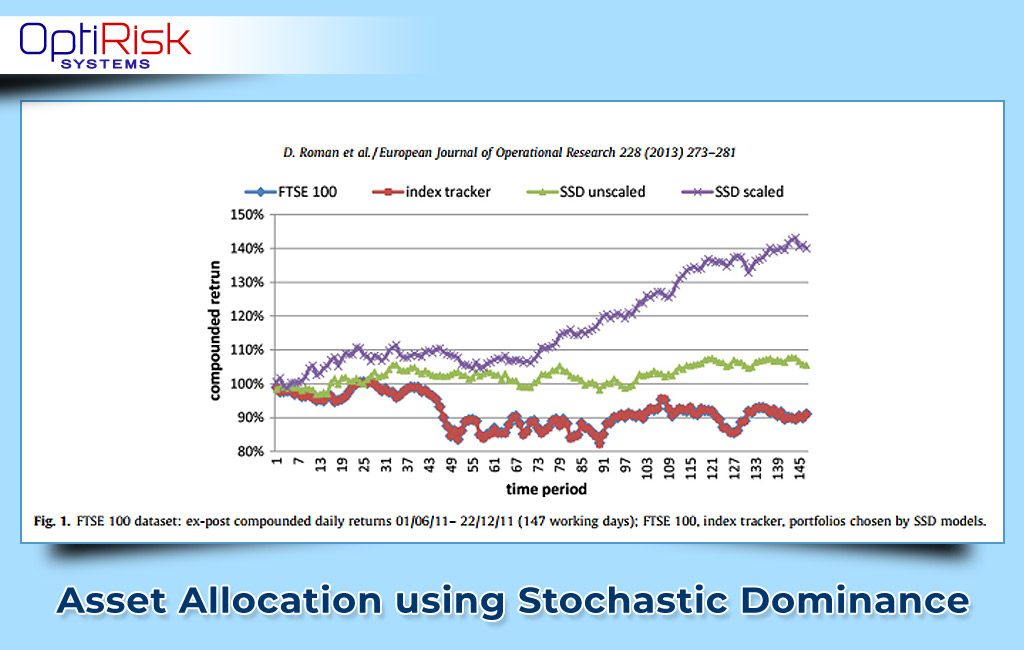

Asset Allocation using Stochastic Dominance

Portfolio Construction and Asset Allocation

Stochastic Dominance has been applied in the domain of finance for several decades. It is most commonly applied in investment and the economics of uncertainty (e.g., portfolio diversification, defining risk, estimating bankruptcy risk, capital structure, and determining option’s price bounds).