Our Products

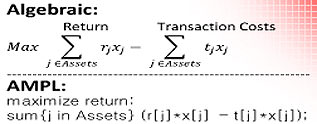

Algebraic Modelling Language Family

Sentiment Analysis

Financial Analytics for Asset Allocation

Whitepapers

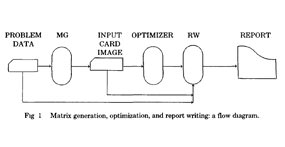

UIMP: User Interface for Mathematical Programming

UIMP is a matrix-generator report-writer system designed to aid the realization (generation) of mathematical programming models and also the analysis-reporting of the solutions of…

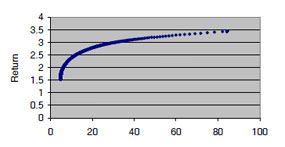

Portfolio Optimization

This white paper introduces Markowitz mean-variance model with a general overview and sets out to explain why and how the finance industry has fully embraced this as a method of choice for portfolio planning.

Portfolio Selection Models: A Review and New Directions

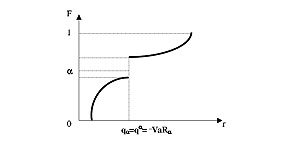

Modern Portfolio Theory (MPT) is based upon the classical Markowitz model which uses variance as a risk measure. A generalisation of this approach leads to mean-risk models

Enhanced Indexation based on Second-Order Stochastic Dominance

Second order Stochastic Dominance (SSD) has a well recognised importance in portfolio selection, since it provides a natural…

Want to see a demonstration or want to know more about our products?

Our Services

Training

OptiRisk Systems offers training in optimization, risk analysis and other quantitative financial tools. We have highly experienced professionals on the teaching faculty…

Projects & Consultancy

We are aware a client is usually interested in having a capped budget for consultancy services. Thus, for a Proof of Concept (POC), the initial step of full client…

AMPLDev Cloud

AMPLDev cloud provides instant access to guaranteed up-to-date versions of our software suite. Removing all installation processes, AMPLDev Cloud directly links…

Trade SES

Sentiment Enhanced Signals (SES) optimizes your equity portfolio composition using a powerful optimization model known as Second Order Stochastic Dominance (SSD)…